"Maximizing Your Savings with a Novated Lease FBT Calculator" for Dummies

Browsing the Complexity of Novated Leases: The Task of an FBT Calculator

Novated leases have become more and more well-liked in current years as a way for workers to finance their cars. This style of leasing plan allows people to rent a car by means of their company, along with the lease repayments being taken off coming from their pre-tax compensation. While novated leases use numerous advantages, they also happen with intricate tax ramifications that can easily be challenging to get through. This is where an FBT personal digital assistant plays a crucial part.

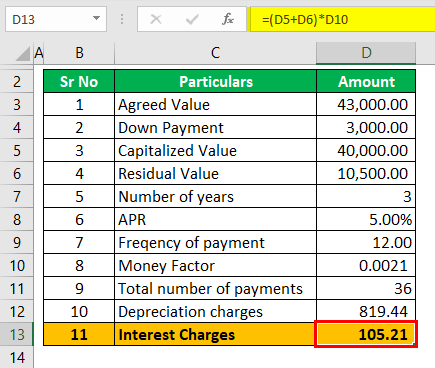

FBT, or Fringe Benefits Tax, is a tax imposed on companies for supplying certain fringe advantages to their employees, featuring novated leases. The quantity of FBT payable depends on numerous aspects, such as the market value of the automobile and how it is made use of. Computing FBT personally can easily be a time-consuming and error-prone method due to the complex attribute of the income tax regulations. This is where an FBT personal digital assistant comes in convenient.

An FBT personal digital assistant is a tool exclusively designed to simplify and improve the process of calculating Fringe Benefits Tax for novated leases. These personal digital assistants use up-to-date tax fees and rules supplied through income tax authorities to make certain precise calculations are helped make. Through going into applicable details such as the value of the motor vehicle, its use patterns, and other appropriate particulars in to the calculator, users can quickly calculate their potential FBT obligation.

One crucial benefit of using an FBT personal digital assistant is that it assists people create informed selections about whether a novated lease is fiscally feasible for them. By suggestionsing various scenarios right into the calculator – such as varying automobile market values or consumption designs – individuals may observe how these variables affect their possible FBT obligation. This makes it possible for them to review different options and pick one that absolute best fits their necessities.

Furthermore, Related Source Here aids employers in dealing with their commitments related to providing novated leases as edge benefits. It aids them accurately calculate and disclose their FBT responsibilities to income tax authorizations, reducing the threat of errors or penalties. This is particularly crucial as FBT observance is a lawful demand that companies need to attach to.

In enhancement to determining FBT liability, some enhanced FBT calculators also offer various other valuable function. For example, they may deliver insights right into the possible tax obligation cost savings affiliated with novated leases matched up to conventional vehicle money management techniques. They may likewise include devices for estimating operating expense such as gas expenses and routine maintenance price, helping customers produce even more informed decisions about their overall lorry finances.

It's worth taking note that while an FBT calculator may streamline the procedure of determining Fringe Benefits Tax for novated leases, it is not a substitute for expert assistance. Income tax regulations and guidelines may be sophisticated and subject to adjustment, so it's consistently suggested to seek advice from along with a qualified tax professional or advisor when creating monetary selections related to novated leases.

In conclusion, navigating the difficulty of novated leases requires mindful point to consider of Fringe Benefits Tax ramifications. An FBT calculator serves as an important tool in this respect by streamlining the procedure of figuring out prospective FBT obligations. Whether you are an employee thinking about a novated lease or an company managing your responsibilities, making use of an FBT personal digital assistant may aid you create informed choices while making sure compliance along with income tax rules.